Businessman Found Guilty in Fraudulent $1 Billion Biodiesel Tax Scheme

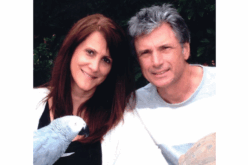

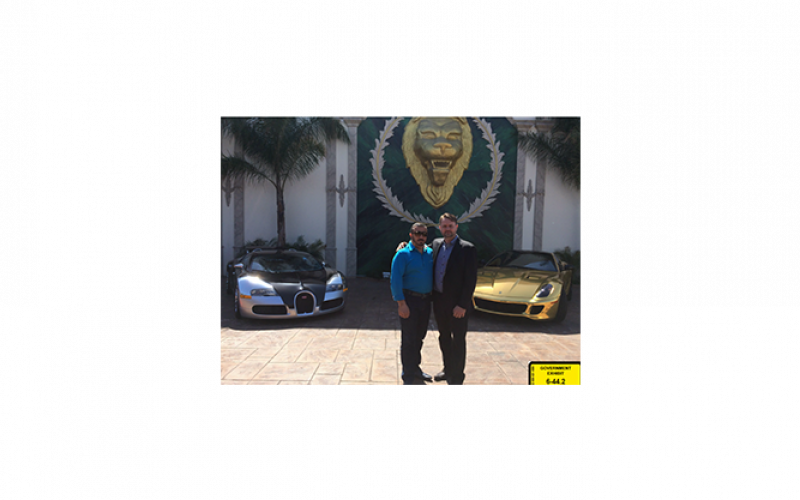

Photo: All Guilty, All Smiles: Derman and Kingston Exchange Fraud-Scheme Gifts with One Another

LOS ANGELES – The Department of Justice (DOJ), Office of Public Affairs has announced the Salt Lake City federal jury’s “Guilty” verdict on 03/16/2020 for Los Angeles businessman Lev Aslan Dermen, also known as Levon Termendzhyan for scheming the goverNment in a $1 billion biodiesel renewable fuel tax fraud.

On board for the announcement were Principal Deputy Assistant Attorney General Richard E. Zuckerman of the Justice Department’s Tax Division, U.S. Attorney John W. Huber for the District of Utah, Don Fort Chief of Internal Revenue Service (IRS) – Criminal Investigation, Acting Special Agent-in-Charge Lance Ehrig for the Denver Area Office of Environmental Protection Agency (EPA) – Criminal Investigation Division, and Special Agent-in-Charge Michael Mentavlos for the Denver Area Office of Defense Criminal Investigative Service.

Derman faces a slew of timely lockups and financial-restitution eventualities at his upcoming sentencing to be set by U.S. District Judge Jill N. Parrish at a later date. At sentencing, he faces a maximum sentence of 20 years in prison for conspiracy to commit mail fraud, conspiracy to commit money laundering, and concealment money laundering, plus 10 years in prison for expenditure money laundering. He also faces a period of supervised release, restitution, and monetary penalties.

Found throughout the years was evidence of activities as “The IRS administers refundable federal tax credits designed to increase the amount of renewable fuel used and produced in the United States,” said the DOJ. “As part of their scheme, Dermen and Jacob Kingston shipped millions of gallons of biodiesel within the U.S. and from the U.S. to foreign countries and back again to create the appearance that qualifying renewable fuel was being produced and sold. They also doctored production and transportation records to substantiate Washakie’s fraudulent claims for more than $1 billion in IRS renewable fuel tax credits and credits related to the EPA renewable fuel standard. To further create the appearance they were buying and selling qualifying fuel, the coconspirators cycled more than $3 billion through multiple bank accounts.”

As a result of these fraudulent claims, “the IRS paid more than $511 million to Washakie and the Kingstons that was distributed between them and Dermen,” said DOJ. “Jacob and Isaiah Kingston sent more than $21 million in fraudulent proceeds to SBK Holdings USA, Inc., Dermen’s California-based company, and sent $11 million to an associate of Dermen’s at his request.

Jacob Kingston used $1.8 million of the fraud proceeds to buy Dermen a 2010 Bugatti Veyron, and they exchanged gifts including a chrome Lamborghini and a gold Ferrari.” See PHOTO, above.

All the while, “Dermen assured Jacob Kingston that he and the Kingstons would be immune from criminal prosecution because they would be protected by Dermen’s “umbrella” of corrupt law enforcement personnel,” said DOJ. “Jacob and Isaiah Kingston transferred over $134 million in fraudulent proceeds to companies in Turkey and Luxembourg at Dermen’s direction, in purported payment for protection.

The jury found Dermen guilty of conspiracy to commit mail fraud, conspiracy to commit money laundering, and money laundering concealment money laundering, and expenditure money laundering.

“These guilty verdicts show that no amount of bank accounts, shell companies, burner phones, or transfers of millions of dollars to foreign countries will stop the Department of Justice, the U.S. Attorney’s Office, and our law enforcement partners from tracking down money stolen from the government and holding criminals responsible for their wrongdoing,” said U.S. Attorney John W. Huber for the District of Utah. “I also want to thank the investigators, prosecutors, and support professionals who have dedicated so much time to this important case.”

Principal Deputy Assistant Attorney General Zuckerman and U.S. Attorney Huber commended special agents of IRS-Criminal Investigation, EPA Criminal Investigation Division, and Department of Defense DCIS who conducted the investigation.

They also thanked Trial Attorneys Richard M. Rolwing, Leslie A. Goemaat, and Arthur J. Ewenczyk and Senior Litigation Counsel John E. Sullivan of the Tax Division, who are prosecuting the case.

They also thanked the U.S. Department of Justice Criminal Division’s Office of International Affairs, as well as law enforcement partners in the Grand Duchy of Luxembourg and the Republic of Malta for their assistance in the case.