Twelve Arrested on Over 100 Felony Counts in Alleged Insurance Fraud Scheme

Twelve individuals have reportedly been arraigned on over 110 felony counts, including conspiracy, insurance fraud, and grand theft, in connection with an alleged disability fraud scheme. The suspects allegedly netted over $450,000 from insurance carriers and over $60,000 from the COVID-19 Relief Program.

Led by the California Department of Insurance, the investigation determined that the alleged ringleaders, a husband and wife from Rancho Cucamonga, used “shell” companies to apply for short-term group disability policies offered by private insurance carriers and through the COVID-19 Relief Program. They then recruited individuals as fictitious employees and filed fraudulent disability claims under those fictitious employees, the Department of Insurance alleges.

“These suspects allegedly used false companies and fictitious employees to take advantage of a system designed to help injured workers,” said Insurance Commissioner Ricardo Lara. “These types of schemes negatively impact consumers and businesses through higher costs. We will continue to work with our law enforcement partners to protect consumers and combat insurance fraud.”

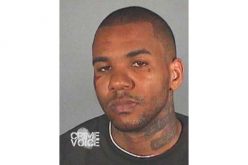

The suspects were arrested throughout the state on Thursday, April 6, and Friday, April 7 of this year. The Office of the Attorney General is prosecuting the case.

“Crimes against a program like the state’s short-term disability fund, which is designed to provide relief to injured Californians by providing them with financial assistance during trying times, will not be tolerated,” said Attorney General Rob Bonta. “Those who steal from these programs are stealing from the families who rely on them. My office will vigorously pursue anyone who commits fraud against these critical programs.”

The Department of Insurance opened the investigation in April of 2020 after receiving several suspected fraud referrals from multiple insurance carriers claiming numerous individuals applied for disability insurance policies using fraudulent information or filed fraudulent disability claims using fraudulent information.

The alleged fraud scheme resulted in a loss of approximately $458,732 to the insurance carriers. The ringleaders collected most of the profit from the scheme and would give those they recruited a percentage of the proceeds for their participation.

Insurance fraud is a serious crime that not only affects the insurance carriers but also the consumers who ultimately bear the cost of fraudulent claims. The California Department of Insurance is committed to protecting consumers and businesses by aggressively pursuing those who engage in fraudulent activity.

The arraignment of these 12 suspects is a reminder that insurance fraud will not be tolerated in California. The Department of Insurance and its law enforcement partners will continue to work tirelessly to uncover and prosecute those who engage in fraudulent activity.