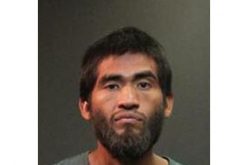

Orange County Man Wanted on Suspicion of Grand Theft and Insurance Fraud

Former insurance agent Phong Thanh Nguyen (29) of Garden Grove has reportedly been charged with two counts of grand theft and insurance fraud. The charges were brought against Nguyen after it was discovered that he allegedly pocketed more than $37,000 in illegally collected commissions from two different life insurance companies.

According to a press release by the California Department of Insurance, the investigation into Nguyen’s activities was initiated following a complaint alleging that Nguyen had received commissions on policies without any intention of keeping those policies active.

The subsequent investigation revealed that Nguyen had written a total of nine policies within a single month, only for these policies to lapse prematurely once he had received the commission. Nguyen did not reimburse any of the unearned commissions obtained through this purported scheme, which constitutes insurance fraud and theft under California law, the Department of Insurance said.

In total, Nguyen managed to accumulate $37,453 through this alleged advanced commission scheme. Nguyen is considered a fugitive, and the Department of Insurance is urging anyone with information regarding his whereabouts to contact them immediately at 714-712-7600.

Additionally, the Department is advising consumers to verify the license status of their insurance agents or to reach out to the Department of Insurance directly at 800-927-4357 if they suspect they may have fallen victim to insurance fraud. Those wishing to verify the license status of their insurance agents online may do so here.

It should be noted that Nguyen’s license expired on December 31, 2020.

The Orange County District Attorney’s Office is currently handling the prosecution of this case. Further developments will be closely monitored as authorities work to bring Nguyen to justice and ensure that any potential victims are provided with the necessary support and assistance.

Insurance fraud can present in multiple forms, many of which are not readily apparent. These include submitting false claims regarding incidents that did not occur or inflating claims for ones that did, staging incidents for the purposes of filing claims later, or selling “phantom policies” (fake policies with no actual coverage) and illegally collecting the premiums.